Thursday, August 28 2014

(INDIANAPOLIS, IN) – There were 60 less homes sold statewide in July than during the same month of last year. This is according to the Indiana Real Estate Markets Report today released by the state's REALTORS®. However, the median price of the 7,803 homes sold last month ($132,000) is 1.5 percent higher than the median price of homes sold in July 2013. The average price of those same homes ($159,032) is also 1.5 percent higher. And, the number of pending home sales in July is 4.8 percent higher, possibly pointing to a stronger-than-expected late summer and early fall. "After double-digit increases in closed sales for all of last year, it would be easy to get discouraged by recent year-over-year comparisons," said Kevin Eastridge, 2014 President of the Indiana Association of REALTORS® and Owner/Managing Broker of the Evansville-based F.C. Tucker Emge REALTORS®. "When you look farther back, you see that housing activity statewide is actually on par with 2007, proving that local markets truly have stabilized." Year-to-date comparisons from the report show -

"Potential sellers should be motivated by the pricing figures in today's report and should also understand conditions could soon change with newly constructed homes presenting a competitive hurdle and economists predicting interest rates will rise in 2015," continued Eastridge. "At the end of the day, housing is always dependent on job creation, wage growth, and credit availability. Provided the economy and the lending environment continue on their current paths, IAR members expect for this report to be about the same for the next few months." IAR represents approximately 15,000 REALTORS® who are involved in virtually all aspects related to the sale, purchase, exchange or lease of real property in Indiana. The term REALTOR® is a registered mark that identifies a real estate professional who is a member of America's largest trade association, the National Association of REALTORS®, and subscribes to its strict Code of Ethics. Monday, July 28 2014

Market Watch July 2014 The halfway point of the year is a good time to see where we are this year compared to last year. Before we look at this year compared to last I think it is important to remember how strong last year was. Both unit sales and dollar volume increased over 21% last year. This was by far the biggest year over year increase we have ever had. It is not surprising that our results this year have been much more mundane. Unit sales this year have declined by 6.3% while average prices have increased just over 2%. While I would never say I’m happy with a reduction in sales, the truth is I’m not really that disappointed. Increases like we saw in 2013 are clearly unsustainable. A moderate decline in unit sales this year demonstrates that the market has fully recovered from the housing recession. I believe that by the end of this year we will be closer to 2013 levels than we are now. There are two specific reasons I feel this way. One is that the last two months of 2013 were very weak compared to the first ten months. The second is that the first two months of 2014 were significantly slower than the March through June period. The two biggest factors affecting the housing market going forward are job growth and inventory levels. Job growth has clearly been sluggish for the past few years but has begun to show some improvement in recent months. Inventory levels are still significantly below historical levels. The best way to increase inventory is to build more new homes. I do believe that construction levels will continue to increase but not as fast as fast as the market demands. Over the second half of the year I do not expect to see the dramatic monthly swings we saw earlier this year. I expect inventory levels to remain a challenge and I believe that if job growth improves, so will real estate sales. If you are in the market to buy a home you must be prepared to make an offer on a home as soon as it is listed and you had a chance to see the home. Homes that are updated and priced right sell within days. If you are in the market to sell your home you are in a good position. We have very low inventories. In either case, if you are buying or selling, call me on my cell phone 812-499-9234 or email at RolandoTrentini@FCTE.com Wednesday, January 22 2014

Market Watch January 2014 Before we talk about 2014, I think this is an excellent time to compare the real estate market in 2013 to the previous year. My ulterior motive is that from virtually any perspective 2013 was a great year! Unit sales in our market increased just over 10% from 2012 to 2013, while the median price increased 2.2% over the same time frame. While these increases did not improve quite as much as our statewide increases of 13.6% in units and 4.2% in median sales price this was still an excellent year. If you remember Market Watch from a couple of months ago, I pointed out then that the decline in unit sales and median prices was not as great as the state as a whole so I did not expect the increase to be as strong either. 2013 was the best year we have ever had in sales volume. This was the first time that F. C. Tucker Emge Realtors closed over $400 million in sales volume. In addition to the increase in both homes sold and in prices, there was even more good news. Both days on market and the list price to sales price ratio also improved. Homes are now selling, on average, about 100 days after they are listed, down from 122 days at the beginning of 2012. The final list price to sale price ratio averaged just under 96% for all of 2013. Both of these numbers are sustainable and are good indicators of a stable market. One statistic that is outside the normal range is the number of homes currently for sale. As of mid December there were 2,326 homes for sale in our MLS. This is the lowest number of homes on the market since May of 2005. The message here is that if you are considering selling your home, get it on the market now. The spring selling season always starts sooner than most sellers think. On average, buyers look for 10 weeks before buying a home. Since it takes 30-45 days for a typical transaction to close, buyers who will actually move in April or May are looking for homes online today. Don't miss the best time of year to get your home on the market, and keep in mind the most visited local website is FCTuckerEmge.com. If you haven't already registered to receive email notifications of new listings in you geographic area or price range give me a call and I can help you register. You can even help friends or family find what they are looking for. Give me a call if you have any questions about our market or specific questions about the value of your home. You can reach me on my cell phone 812-499-9234 or email Rolando@RolandoTrentini.com Tuesday, January 07 2014

If there is one question that homeowners and prospective shoppers have in common as we enter the New Year, it’s about the direction of local real estate values in 2014. Small wonder: the financial market meltdown of the last decade had such a profound impact on all forms of real estate that it still has many people looking nervously over their shoulders. How likely is another tumble in the coming 12 months? Will real estate values in Evansville continue to rise? Knowing the answer could make a big difference to anyone planning to buy or sell a home in the area this year. Of course, absolute certainty on that score is not possible for anyone without a time machine in their basement. But, as we look back over last year, we might gain a little bit more confidence by hearing from the experts who got it right in 2013. Foremost among them was Dr. Lawrence Yun, the chief economist of the National Association of Realtors®. Last year, he was dead-on. Dr. Yun is calling for a continued rise in prices—pretty much in line with the past year’s gains. To compensate for expected mortgage interest rate gains—the likely effect of the Federal Reserve’s easing of policies that fueled 2013’s financial markets—he suspects that lending institutions will ease borrowing strictures. That’s something we can all applaud! Overall, if local real estate values in 2014 follow the NAR’s national prognostications, we would expect real estate value increases either like the Wall Street Journal’s quoted prediction of 6%, or of Dr. Yun’s 5%. Either would not be surprising, given last year’s real estate values numbers. What the NAR experts and the Journal also agree upon is a flattening of residential housing sales volume in line with 2013 levels. How much credence can we give to what the seers predict? Perhaps a little more than usual. “The NAR forecast could be viewed as restrained in light of the housing market’s gains in the past two years,” says the Journal; and “…other 2014 forecasts are fairly close to Mr. Yun’s predictions.” Thinking of selling a home in Evansville this winter? Call me for a complimentary consultation. I’m always here to offer the best current marketing ideas! You can reach me on my cell phone 812-499-9234 or email Rolando@RolandoTrentini.com Monday, December 02 2013

Market Watch Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), recently gave his annual forecast for home sales for 2014. Dr. Yun has been the chief economist for NAR for several years and was recognized last year by USA Today as one of the top 10 economists in the country. His estimate for sales of existing homes in 2014 is 5.12 million homes, virtually identical to 2013’s 5.13 million sales. He expects new home sales to reach 508,000 in 2014 compared to 429,000 in 2013. This forecast says total sales will be essentially identical to last year. Although sales may remain flat he expects prices to rise 6% over last year. Steady sales with healthy a price increase is actually pretty impressive when one considers how much sales and prices have improved over the past two years. Over the past two years cumulative unit’s sales have climbed 20% and prices have increased 18%. Those kinds of increases are clearly not sustainable which make this year’s prediction very positive. Although prices are up Dr. Yun points out “We’ve come off record high housing affordability conditions in the past year, and are now at a five year low, but conditions are still the fifth best in the past 40 years.” Dr. Yun also said that limited inventory; exacerbated by low numbers of new home construction, as well as a tsunami of new federal banking regulations, would hold back home sales. As is always the case, national statistics are interesting but your home or the one you are thinking about buying are even more interesting. Trends in our market have been similar but less pronounced that the national numbers. What is accurate locally is that although sales and prices have increased, homes are still very affordable. If you would like to know the market value of your home or you are ready to start looking for a new one give me a call. Although real estate is somewhat seasonal, homes do sell during the holidays and in January. There is less competition in the winter and buyers planning to buy in the spring usually start looking months before they buy. Thursday, October 31 2013

Market Watch The national landscape for real estate has changed over the course of this year. Clearly 2013 has been an excellent year for real estate sales nationwide. Nationally year-to-date unit sales through September climbed 15%, while statewide units were up 14% and our local market increased 16%. Although these numbers are excellent the market is experiencing some other changes. The mix of buyers has changed over the past few years. Investors represented about 34% of all buyers so far this year, while the percentage of first time buyers is fewer than 30%, a significant drop from historical levels, which have been closer to 40%. This relatively high percentage of investor buyers suggests that professional investors still feel real estate is a good investment. First time buyers have not declined because they don’t want to own their own home. Contrary to some articles you may have seen, the desire to own a home continues to be a goal across age groups. Survey after survey shows that if buyers have the ability to own a home they have a strong preference for owning vs. renting. There are two very clear reasons that the number of first time buyers has declined. One reason is the difficulty in obtaining mortgage loans. Increased banking regulations have made borrowing money an onerous process. Lenders have money and want to lend, unfortunately they are required to comply with expensive regulations making the entire process more cumbersome for everyone. One additional positive in the housing market is the continued improvement in homeowner equity. Short sales and foreclosures have unfortunately been a significant portion of the market the past few years. With improved prices and more buyers the number of homes “underwater” has declined significantly. Current estimates suggest that over 8 million homeowners who currently owe more than their home is worth will be in a positive equity situation over the next 15 months. Strong demand from investors, a strong desire to own vs. rent, and an improved equity situation all suggest that housing will stay strong for the foreseeable future. Best wishes for the upcoming holiday season and please let me know if I can help with any of your or your friends housing needs. You can reach me on my cell phone 812-499-9234 or email Rolando@RolandoTrentini.com Monday, September 09 2013

MARKET WATCH

There are a lot of positive things to discuss about real estate in this month’s Market Watch, both locally and nationally. Although from both perspectives the news is good, the news is not necessarily the same. According to Lawrence Yun, chief economist for The National Association of Realtors, sales prices nationally are 13.7% above last year’s levels. Prices are still 7.3% below their all time high (July 2006). Days on market data is more difficult to obtain accurately but best estimates are in the 60-70 day range. There is currently a 5.1 month supply of homes on the market. Several factors influence these statistics. Cash buyers represent 31% of the market. This segment is largely represented by investors, who obviously view real estate as an attractive long term investment. Distressed properties represented 15% of all sales in July. That percentage is down about 40% from its high but is still almost double the historical average. This suggests that shadow inventory is disappearing, which is good, but it will still take a couple of years to get back to historically normal levels. Finally, first time buyers currently represent about 29% of the market, substantially below the normal 40-45% of the market. Locally, our market is very similar to the rest of the nation in terms of month’s supply of inventory. We currently have a little under 5.3 months supply and have been under six months supply since April. Our days on market is higher than most of the country and is still just over 100 days. The most interesting comparison however is sales price and how it has changed. While year-to-date sales prices are only up 4.7% from last year’s average our market is now at the highest level of both average and median prices we have ever seen. The median price in our market declined for 4 consecutive years and our low point was in 2009. Since that time our median price has increased every year with this year representing the highest average and median prices we have ever experienced in this market. While it may not feel that way our market simply did not decline as much as the nation as a whole and our market has, at least in terms of price, completely recovered from the recession. One interesting thought I had after looking at this data was that it all made sense to me except I would have thought our days on market would be lower than it is, given all of the other market conditions. I asked another Realtor in our office what she thought and she said “It’s simple. Houses priced right in excellent condition sell quickly. Houses that need work or are a little over priced just sit on the market”. She is right. If you want to know the right price for your home or if you need some tips on getting your house ready to sell give me a call today. If you want to see some homes visit FCTuckerEmge.com or give me a call. You can reach me on my cell phone at 812-499-9234. Tuesday, July 30 2013

Last month I said I would make this month’s Market Watch a comparison of the first six months of 2012 to the first six months of 2013. I knew this would be fun because by every measure, the first six months of 2013 have been better than the first six months of 2012.

Our area’s increase is in line with statewide changes. Nationally we exceeded unit increases and trailed price changes. Statewide unit sales increased 17.8% and the average price increased 4.3%. Nationally unit sales increased 13% and prices jumped 15%. We are very proud of our performance at F.C. Tucker Emge Realtors through the first six months of the year. As a potential seller you should be very happy to know that our days on market and our list price to sale price are significantly better than our competition. Our days on market for the first six months of this year were 97 days (compared to the market of 111 days) and our list price to sale price ratio for the same period was 97.36%, a full percentage point higher than the competition. This means that on the average transaction at F.C. Tucker Emge Realtors our clients sold their house 12.6% faster and our seller received over $1,600 more for their house than did clients of our competitors. Enjoy the rest of the summer and please call or email if I can help with your or any of your friends real estate needs. You can reach me on my cell phone 812-499-9234 or email Rolando@RolandoTrentini.com Thursday, May 30 2013

Market Watch Although home sales have improved across all regions of the country, including our local market, I believe there are some subtle differences in both the results and the reasons. First, from a national perspective, existing home sales increased again in April to an annualized rate of almost 5 million homes. This is up 9.7% from the same time last year. According to the National Association of Realtors (NAR) median sale prices for existing homes were up 11% in April compared to April of 2012. Nationally foreclosures and short sales accounted for 18% of sales in April, down significantly from 28% last April. Finally the days on market number nationally has declined significantly to only 46 days this April compared to 83 days last April. Locally we have seen improvements in all of the same areas but for the most part they have not been as dramatic. For the first four months of this year unit sales, (both existing and new combined) have increased 9.1% over the first four months of last year. I am confident that trend will continue for the next couple of months based on pending activity which has already occurred. Our improvements in days on market and average prices have been much less spectacular. Both have improved but not by statistically significant amounts. We have however seen a .67% improvement in the list price to sale price ratio or just over $1,000 on a sale price of $150,000. There is a big difference in the reason for today’s sales figures and the real estate boom of 2005 and 2006. In 2005 and 2006 the market was fueled by “easy money”, meaning lending standards were too lenient and a significant number of buyers were ultimately foreclosed upon. Today’s market is based on a more tested economic reality, supply and demand. Nationally in April there was a 5.2 month supply of homes on the market. Locally April supply was similar at 5.65 months supply. Three reasons for this decline in inventory are reduced foreclosures, a return to a more normal level of buying activity and new construction has not caught up to current demand. What does all this mean to you? If you are a buyer, interest rates are at bargain prices and local home prices have not increased dramatically. Both interest rates and home prices will ultimately rise. If you are a seller, housing supply has decreased and new construction has not caught up so there is less competition. If you would like to know what your house is worth give me a call and I can help you determine the market value of your home. If you are thinking about buying you can see what’s on the market at FCTuckerEmge.com or just give me a call. You can reach me on my cell phone at 812-499-9234 or email Rolando@RolandoTrentini.com Thursday, April 04 2013

February pending home sales flattened with limited buyer choices, but remained at the second highest level in nearly three years, according to the National Association of Realtors®.

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, slipped 0.4 percent to 104.8 in February from a downwardly revised 105.2 in January, but is 8.4 percent higher than February 2012 when it was 96.6. Contract activity has been above year-ago levels for the past 22 months; the data reflect contracts but not closings. Before January, the last time the index showed a higher reading was in April 2010 when it was 110.9, shortly before the deadline for the home buyer tax credit. Lawrence Yun , NAR chief economist, said limited inventory is holding back the market in many areas. "Only new home construction can genuinely help relieve the inventory shortage, and housing starts need to rise at least 50 percent from current levels," he said. "Most local home builders are small businesses and simply don't have access to capital on Wall Street. Clearer regulatory rules, applied to construction loans for smaller community banks and credit unions, could bring many small-sized builders back into the market." The PHSI in the Northeast declined 2.5 percent to 82.8 in February but is 6.8 percent above February 2012. In the Midwest the index rose 0.4 percent to 103.6 in February and is 13.2 percent higher than a year ago. Pending home sales in the South slipped 0.3 percent to an index of 118.8 in February but are 12.1 percent above February 2012. In the West the index increased 0.1 percent in February to 101.4 but is 0.8 percent below a year ago. Yun projects existing-home sales to rise about 7 percent in 2013 to approximately 5 million sales, which is near the current level of activity. "The volume of home sales appears to be leveling off with the constrained inventory conditions, and the leveling of the index means little change is likely in the pace of sales over the next couple months," he said. The national median existing-home price is forecast to rise nearly 7 percent this year, while mortgage interest rates should remain historically low, but trend up slowly and reach 4 percent in the fourth quarter. The National Association of Realtors®, "The Voice for Real Estate," is America's largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries. For additional commentary and consumer information, visit www.houselogic.com and http://retradio.com. Read more here: http://www.realtor.org/news-releases/2013/03/pending-home-sales-slip-on-constrained-inventory

Monday, March 11 2013

Market Watch

This month I want to recap the local real estate market in 2012 compared to 2011. This is especially easy since our market improved in virtually every category last year.

The easy place to start is closed transactions. Our BLC (broker listing cooperative, which used to be called MLS) closed 4,387 home sales last year up 8.83% from 2011. The median sales price increased 4.4% increasing our average sales price to $125,971. Days on market decreased 11.3% compared to 2011 but is still higher than I like, at 105 days.

The big news, which I have mentioned frequently over the past year, is that the months supply of homes listed for sale continues to decline. The average for 2012 was 7.32 months down from 8.70 months in 2011 and 9.43 in 2010. This is the lowest average level in 6 years. As of today there are fewer than 2,400 active listings on the market. My records do not go far enough back to find fewer active listings than this. If you are considering selling your home, now is the time to list. I am confident that new home construction will increase significantly this year. Homes listed now will reach the market before these new homes are completed and on the market.

If you are considering listing your home, no one has better tools to market your home. Traffic on FCTuckerEmge.com and Tuckermobile.com are higher now than they have ever been. In fact, visits to FCTuckerEmge.com for the first two months of the year are up almost 11% versus the same time last year. With over 95,000 visits, FCTuckerEmge.com is the source for information on real estate in our area. And don’t forget that TuckerMobile.com is always with you on your smart phone!

Please let me know if you know of anyone considering selling their home. I would be happy to prepare a market analysis and help them sell their home. Tuesday, January 15 2013

Market Watch

Normally in January’s Market Watch I try to compare results from the past two years. Although I may mention a few comparisons, the overriding message in this Market Watch is pretty simple – if you are considering selling your house list it now! There are several reasons I feel so strongly about this.

First, nationally the inventory of existing homes for sale is at its lowest number since 2001. Locally our inventory is at its lowest level since January of 2006. Many sellers thinking about selling wait until April or May to list their homes, thinking that is when the selling season starts. Based on my experience, the spring selling season begins on Super Bowl Sunday! Last year in the four month February to May time period we sold exactly 33% of the homes that were sold over the course of the entire year. Waiting to list your home doesn’t make it more likely to sell, it just costs time. As more homes come on the market the competition increases so take advantage of buyers who are looking now.

Second, prices are up. The National Association of Realtors reports that nationally median home prices are up 10.1% from a year ago and through November prices increased for the ninth consecutive month, the longest streak since 2006. Locally our median price increased 4.3% from last year and I am confident that the median price will continue to rise this year.

Shadow inventory (homes 90 days delinquent, homes in foreclosure, and homes already owned by lenders) continues to decline. Although it is impossible to know exactly how many homes meet these criteria, virtually all experts agree that the number has declined significantly. Although there will continue to be some of these homes listed the number will be significantly less than in recent years, creating less competition for normal home sellers and less competition means higher prices.

Fourth, rental rates and occupancy continue to increase making homeownership more affordable in many cases, than renting. This coupled with increased consumer confidence in the housing industry, an increased desire nationally to own a home and increasing household formation all combine to generate more buyers.

If you or anyone you know is considering selling their home why wouldn’t they list it with the company that has been helping buyers and sellers for over 100 years and the company with the absolute best website for shoppers looking to buy in our area? Please visit FCTuckerEmge.com or better yet call me today. Let’s get started now.

Thursday, January 03 2013

The Indiana Association of Realtors is reporting increases in November closed home sales. The organization says that number jumped 26.2 percent, compared to the same month in 2011. The average sale price throughout the state increased 5.1 percent. The Indiana Real Estate Markets Report today released by the state’s REALTORS® shows that statewide, when comparing November 2012 to November 2011, the following occurred: • The number of closed home sales increased 26.2 percent to 5,566, “Home sales continued to increase through the end of November suggesting that Hoosiers’ belief in homeownership remains strong as the year comes to a close,” said Karl Berron, Chief Executive Officer of the Indiana Association of REALTORS®. “But the biggest story of today’s report and perhaps the whole year is that homes have not only held their value, but also made price gains.” The good news made last month is part of a trend that proves local residential real estate markets across the state continue to strengthen from the worst of the recession. November 2012 marks the following consecutive year-over-year gains in home prices and market activity: • The number of closed home sales has increased year-over-year for 17 consecutive months, Anyone looking to buy or invest should start with the sortable county tables of this report and then talk to a local REALTOR® who can give the most insight into what’s happening in a neighborhood, city or school district. Established in May 2009, the Indiana Real Estate Markets Report was the first-ever county-by-county comparison of existing single-family home sales in Indiana. In March 2010, IAR added statistics on other types of existing detached single-family (DSF) home sales – condominiums, duplexes, townhomes, mobile homes, etc. – to the report. The report became even more robust in August 2010. It now tells how the statewide housing market is performing according to eight different indicators, each with one-month and year-to-date comparisons, as well as a historical look. It also provides specific county information for 91 of Indiana’s 92 counties in a sortable table format, allowing for consistent comparison between local markets. IAR obtains the data directly from and releases this report in partnership with 26 of the state’s 27 Multiple Listing Services (MLSs), including the Broker Listing Cooperative® (BLC®) in both central and southwestern Indiana. IAR represents approximately 15,000 REALTORS® who are involved in virtually all aspects related to the sale, purchase, exchange or lease of real property in Indiana. The term REALTOR® is a registered mark that identifies a real estate professional who is a member of America’s largest trade association, the National Association of REALTORS®, and subscribes to its strict Code of Ethics. Source: Indiana Association of Realtors http://www.insideindianabusiness.com/newsitem.asp?ID=57258 Wednesday, November 28 2012

Market Watch

As I mentioned last month I will recap Lawrence Yun’s economic/real estate forecast for 2013. Lawrence Yun PhD is the chief economist for the National Association of Realtors. He graduated from Purdue University and received his doctorate in economics from The University of Maryland. He serves on Harvard University’s Industrial Economic Council and has been recognized as one of the top ten economic forecasters in the country.

Dr. Yun is more optimistic about real estate than the economy as a whole. He anticipates sales of existing homes to reach 5 million units next year with the median price up 5% and median prices up almost 15% over a three year period. He also anticipates new construction to increase next year by 25%. Although a 25% increase is a huge increase it is important to note that new construction has been very low for three years and new construction inventory is at a 50 year low. Interest rates should stay low for at least two more years. GDP will rise about 2% next year.

Both Dr. Yun and Mark Vitner, Managing Director and Sr. economist with Wells Fargo spoke at the same economic presentation. Both economists assume that we will not have a recession next year. Both also point out that to avoid a recession we must reduce our deficit and to reduce our deficit we must implement significant entitlement reform.

Dr. Yun, The National Association of Homebuilders and Wells Fargo all point out that homes are more affordable today than they have been in decades. Seventy four percent of all homes sold in the 3rd quarter were affordable to families making the median household income of $65,000.

If you haven’t signed up for My F.C. Tucker Emge on our website please do or call me for instructions. New enhancements to our map search at FCTuckeremge.com have made shopping for a home easier than ever. You can reach me on my cell phone at 812-499-9234. Monday, October 15 2012

Market Watch

We are three quarters of the way through the year, sold units through September are 5% ahead of last year and, the median sale price is up 3.3%. Sales this year have exceeded those in the corresponding month last year in 7 of 9 months. Unfortunately, September was one of those two months. I am confident that there is a valid reason for this decline. I have felt for a long time that contested Presidential elections have a short-term, negative impact on real estate sales. Earlier this month I saw a national survey that confirmed my thoughts. According to this survey, 12% of potential homebuyers would definitely delay purchasing a home until after the election and 13% of potential homebuyers might delay their purchase until after the election. Fortunately closed sales locally were only 7.6% below last September. The good news is that the election is less than a month away and I expect a return to normal activity after that.

Another national trend I have been following is the steady decline in foreclosures and shadow inventory. Shadow inventory includes homes currently in the foreclosure process, homes owned by lenders not yet listed for sale and homes 90 or more days delinquent on their mortgage payments. Although these numbers are impossible to track with exact precision, virtually every group that tracks this information shows a steady decline in these numbers. As these homes continue to be removed from the market it cannot help but have a positive impact on both prices and new construction.

As is almost always the case, our Marketing Department is continually making improvements and enhancements to our website, FCTuckerEmge.com. We will soon have a substantially improved interactive map search and will also start providing information on sold properties. Our local Multiple Listing Service requires users to log in before we can provide this sold information. Simply sign up for a MyFCTuckerEmge.com account and you can search sold properties. Or you can always call or email me and I will be happy to get the information for you. Enjoy the beautiful fall weather and next month I will give you some economic information from our annual National Association of Realtors convention, which is always a great source of information. You can reach me on my cell phone at 812-499-9234. Friday, July 27 2012

Home prices and market activity held strong during June according to themonthly Indiana Real Estate MarketsReport today released by the state’s REALTORS®. Highlightsfrom the report include: • The median sale price of homes statewide is in its seventh consecutivemonth of year-over-year increases and back to a level not seen since 2007. “Forthe third month in a row, the statewide housing market has made very goodnews,” said Karl Berron, Chief Executive Officer of the Indiana Association ofREALTORS®. “Home prices and market activity were strong during June which is a resultof pent-up demand and continued low interest rates. It’s also because homesacross Indiana have historically held value, so real estate here has long beenviewed as a wise investment. “Thedemand will only be sustained if Hoosiers are working and confident in theirlong-term employment,” continued Berron. “So we are listening for economicdevelopment plans and watching jobs numbers closely.” Gettingback to the traditional year-over-year comparisons of the Indiana Real Estate Markets Report, statewide, when comparing June2012 to June 2011: • The number of closed home sales increased 11 percent to 6,750; Anyonelooking to buy or invest should start with the sortable county tables of this reportand then talk to a local REALTOR® who can give the most insight into what’shappening in a neighborhood, city or school district. Source: http://www2.realtoractioncenter.com/site/MessageViewer?em_id=138603.0&autologin=true Monday, March 19 2012

Market Watch

I have one important message in this month’s Market Watch: If you or someone you know is thinking about selling their house, list it NOW. Seriously, I know that sounds like a Realtor talking but it is also the truth. Let me tell you why.

Combined January and February closed transactions are up 5% from last year and up 17% from 2010. The number of homes currently listed is down 10.1% from last year and down 17.6% from 2010. When sales increase, as they have, and listings decrease, as they have, the month’s supply of homes also decreases. It will then be no surprise that average month’s supply has also declined significantly. The average month’s supply this year is 16.2% less than last year and 30.7% less than 2010. The absolute number of active listings is down over 33% from its peak. If we close the same number of homes this March as we did last year in March and active listings don’t increase we will only have 6.28 month’s supply of homes on the market. The supply of homes has been that low for exactly one month since June of 2006. That was for the month in which the last home buyer tax credit expired, clearly an aberration.

Winter decided to skip us this year. The home buying season has already started. Home affordability (a calculation based on average household income, median home price and mortgage interest rates) is at an all time high. Homes have never been more affordable and there are not too many on the market.

No one has better tools to market your house and FCTuckerEmge.com is the best local website for shoppers in our market. Opportunity is knocking. Call me now and take advantage of today’s housing environment. You can reach me on my cell phone 812-499-9234 or by email Rolando@RolandoTrentini.com

Kathy and I wish you a happy and safe spring season. Wednesday, November 30 2011

New-home sales for single-family homes rose 1.3 percent in October, marking the best pace for new-home sales activity since this May, the U.S. Commerce Department reports.

Following the sector’s worst year for new-home activity on record last year, several recent reports are suggesting a pick-up in new construction. "Builders have been seeing some marginal improvement in sales activity over the past few months, particularly in select markets where consumer confidence is higher due to improved economic conditions," Bob Nielsen, chairman of the National Association of Home Builders, said in a statement. "While this trend is encouraging, overall sales activity is still well below normal due to the effects of overly tight credit conditions for builders and buyers, the continued flow of distressed properties on the market, and inaccurate appraisal values on new homes." Despite the October gain in sales, new-home sales for the month were at an annual rate of 307,000--still less than half the 700,000 in sales that most economists consider healthy for the housing market. A Regional LookA break down of sales by region in October:

Inventory Drops DrasticallyNationwide, the inventory of new homes for sale stayed at an all-time record low of 162,000 units in October. "Particularly encouraging is the fact that builders continue to hold down their inventories to match the current sales rate, with the number of new homes for sale now down to a sustainable, 6.3-month supply," NAHB Chief Economist David Crowe said in a statement. By Melissa Dittmann Tracey, REALTOR® Magazine Daily News http://realtormag.realtor.org/daily-news/2011/11/29/new-home-sales-post-biggest-gains-in-months Friday, October 28 2011

Home sales in the Evansville area were up nearly 15 percent in the third quarter of 2011, compared to the same period last year, with Gibson County the only county in a four-county Southwestern Indiana metro area showing a slight decline. At the same time, Gibson County led the way with a sharp increase in median home prices, an apparent result of near-back-to-normal operations at Toyota Motor Manufacturing Indiana near Princeton. Median prices also rose in Vanderburgh and Warrick counties. The median increase in the four-county area was more than 10 percent better than in the July-September period last year, with a decline reported only in Posey County. Still, the developments last quarter are part of a year where home sales in Vanderburgh and the three surrounding Hoosier counties together are lagging behind those in the first nine months of 2010. But average home prices for the year to date are up. Sales so far this year are 4.8 percent behind last year, but the average sale price is up 4.6 percent and the median sales price is up 3.1 percent. The new quarterly statistics are "part of a period of stabilization we've seen over the past two years" in local residential sales, said Bob S. Reid, president of Appraisal Consultants Inc. of Evansville, which compiled the data. "Property values are holding, and sales are steady also," he said. The period from 2007 through most of 2009 saw a substantial decline. Read more here: Evansville Courier-News Monday, September 26 2011

Existing-home sales increased in August, even with ongoing tight credit and appraisal problems, along with regional disruptions created by Hurricane Irene, according to the NATIONAL ASSOCIATION OF REALTORS®. Monthly gains were seen in all regions.

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 7.7 percent to a seasonally adjusted annual rate of 5.03 million in August from an upwardly revised 4.67 million in July, and are 18.6 percent higher than the 4.24 million unit level in August 2010. Lawrence Yun, NAR chief economist, said there are some positive market fundamentals. “Some of the improvement in August may result from sales that were delayed in preceding months, but favorable affordability conditions and rising rents are underlying motivations,” he said. “Investors were more active in absorbing foreclosed properties. In additional to bargain hunting, some investors are in the market to hedge against higher inflation.” Investors accounted for 22 percent of purchase activity in August, up from 18 percent in July and 21 percent in August 2010. First-time buyers purchased 32 percent of homes in August, unchanged from July; they were 31 percent in August 2010. “We had some disruptions from Hurricane Irene in the closing weekend of August, when many sales normally are finalized, along the Eastern seaboard and in New England,” Yun said. “As a result, the Northeast saw the smallest sales gain in August, and some general impact is expected in September with widespread flooding from Tropical Storm Lee. Aberrations in housing data are possible over the next couple months as markets recover from disrupted closings and storm damage.” Yun said an extremely important issue currently is the renewal and availability of the National Flood Insurance Program, scheduled to expire at the end of this month. “About one out of 10 homes in this country need flood insurance to get a mortgage, and we would see significant negative market impacts without it,” he said. According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to 4.27 percent in August, down from 4.55 percent in July; the rate was 4.43 percent in August 2010. Last week, Freddie Mac reported the 30-year fixed rate fell to a record low 4.09 percent. NAR President Ron Phipps, broker-president of Phipps Realty in Warwick, R.I., said the market is remarkably affordable for people with secure jobs, good credit and long-term plans. “All year, the relationship between home prices, mortgage interest rates and family income has been hovering at historic highs, meaning the best housing affordability conditions in a generation,” he said. “The biggest factors keeping home sales from a healthy recovery are mortgages being denied to creditworthy buyers, and appraised valuations below the negotiated price. Buyers may be able to find more favorable credit terms with community and small regional banks, and Realtors® can often give buyers advice to help them overcome some of the financing obstacles,” Phipps said. Contract failures – cancellations caused largely by declined mortgage applications or failures in loan underwriting from appraised values coming in below the negotiated price – were reported by 18 percent of NAR members in August, up from 16 percent July and 9 percent in August 2010. The national median existing-home price for all housing types was $168,300 in August, which is 5.1 percent below August 2010. Distressed homes – foreclosures and short sales typically sold at deep discounts – accounted for 31 percent of sales in August, compared with 29 percent in July and 34 percent in August 2010. Total housing inventory at the end of August fell 3.0 percent to 3.58 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, down from a 9.5-month supply in July. Single-family home sales rose 8.5 percent to a seasonally adjusted annual rate of 4.47 million in August from 4.12 million in July, and are 20.2 percent above the 3.72 million pace in August 2010. The median existing single-family home price was $168,400 in August, which is 5.4 percent below a year ago. Existing condominium and co-op sales increased 1.8 percent a seasonally adjusted annual rate of 560,000 in August from 550,000 in July, and are 8.3 percent higher than the 517,000-unit level one year ago. The median existing condo price was $167,500 in August, down 3.3 percent from August 2010. Regionally, existing-home sales in the Northeast increased 2.7 percent to an annual pace of 770,000 in August and are 10.0 percent above a year ago. The median price in the Northeast was $244,100, which is 5.1 percent below August 2010. Existing-home sales in the Midwest rose 3.8 percent in August to a level of 1.09 million and are 26.7 percent above August 2010. The median price in the Midwest was $141,700, down 3.5 percent from a year ago. In the South, existing-home sales increased 5.4 percent to an annual pace of 1.94 million in August and are 16.9 percent higher than a year ago. The median price in the South was $151,000, which is 0.8 percent below August 2010. Existing-home sales in the West jumped 18.3 percent to an annual pace of 1.23 million in August and are 20.6 percent higher than August 2010. The median price in the West was $189,400, down 13.0 percent from a year ago. Source: NAR http://://realtormag.realtor.org/daily-news/2011/09/21/august-existing-home-sales-leap-despite-headwinds Wednesday, July 27 2011

Housing data for June shows pending sales increased 16.4 percent statewide. The report from the Metropolitan Indianapolis Board of Realtors and the Indiana Association of Realtors also indicates the median sales price rose 1.4 percent. IAR Chief Executive Officer Karl Berron says "pending sales are a good measure of confidence." INDIANAPOLIS – In the first half of 2011, decreased housing activity and stable prices defined the central Indiana market. Housing data released today for June 2011 provided a brighter picture for the future, including increased prices and an abundant number of pending sales. This is according to data in a jointly released report from the Metropolitan Indianapolis Board of REALTORS® (MIBOR) and the Indiana Association of REALTORS® (IAR). In central Indiana, the average sales price of homes increased by 1.1 percent to $150,797 during the first six months of 2011 when compared to January-June 2010. Average sales price also rose in the three month comparison by 2.2 percent to $156,999 and by 2.9 percent in the one month comparison to $164,190. Median sales price during January through June 2011 experienced a drop of 1 percent to $120,788. April through June 2011 median sales prices held steady, while June-only numbers increased 4 percent to $129,999. The number of closed sales in central Indiana decreased by 12.7 percent in the first half of 2011. Closed sales for June show a smaller, 6.3 percent decrease. The surprise number comes in the form of pending sales, while down for the year, up 19 percent for the month of June. Pending sales reflect signed purchase agreements that have yet to close. The robust number bodes well for more closed sales in the coming months. Statewide, when comparing June 2011 to June 2010:

The median sales price increased 1.4 percent to $119,900 Pending sales increased 16.4 percent

“During the last six months, the recovery of the housing market has been slow and steady – not dramatic or flashy,” said Dave Goff, 2011 MIBOR president. “This month, however, has painted an encouraging picture for the remainder of the year. Interest rates are down nationally and local pending sales have climbed drastically, providing a positive outlook.” IAR CEO Karl Berron agreed. “Pending sales are a good measure of confidence. A full recovery lies with jobs, available financing for qualified buyers and less foreclosure inventory. It’s all part of the mix.” Additional key central Indiana findings for January through June 2011:

New listings decreased by 15.2 percent during the six month comparison. Months of supply increased to 9.8 months during the first half of 2011. Total active listings fell by 1.6 percent

The attached data will tell consumers how the central Indiana housing market is performing according to eight different indicators. Each indicator will have one-, three-, six- and 12-month comparisons, as well as a historical look. Consumers will also have access to specific county information for the 13 counties included in MIBOR’s Broker Listing Cooperative® (BLC®): Boone, Brown, Decatur, Hamilton, Hancock, Hendricks, Johnson, Madison, Marion, Montgomery, Morgan, Putnam and Shelby counties. IAR’s report, found online under the Reports tab of www.IndianaIsHome.com, will show consumers the state of Indiana’s housing market according to the same indicators with one-month and year-to-date comparisons, as well as a historical look. Consumers will also have access to specific county information for 91 of Indiana’s 92 counties in a sortable table format. This information has been provided by MIBOR. MIBOR is the professional association representing central Indiana's REALTORS®. MIBOR serves the needs of more than 6,500 members in Boone, Brown, Hamilton, Hancock, Hendricks, Johnson, Marion, Montgomery, Morgan and Shelby counties. MIBOR also supplies the BLC® listing service to REALTORS® in Decatur, Madison and Putnam counties. IAR represents approximately 16,000 REALTORS® who are involved in virtually all aspects related to the sale, purchase, exchange or lease of real property in Indiana. The term REALTOR® is a registered mark that identifies a real estate professional who is a member of the world’s largest trade association, the National Association of REALTORS®, and subscribes to its strict Code of Ethics. Source: MIBOR & InsideINdianaBusiness.com Report http://www.insideindianabusiness.com/newsitem.asp?ID=48881

Tuesday, January 25 2011

The average sales price for residential homes in parts of the tri-state has jumped.

Local realtors say they are seeing an increase in demand when it comes to buying homes. With an increase of money people are getting for their homes, they say that combination could make for a strong housing market in 2011. The Evansville Area Association of Realtors reports a 4.7 percent increase in both the average sale price and median sale price of homes sold in Vanderburgh, Warrick, Posey and Gibson counties, from 2009 to 2010. "The fact that these have gone up means that people are buying more expensive homes which is good and prices have stabilized in the area," says Chris Dickson, President of the EAAR. Other realtors are also happy with the news. "For sellers right now it's a good time to list your home because you can get a little more for you home than in the past," says Walt Caswell, a realtor with ERA. On top of that, more buyers are now looking and willing to spend. "Historically, the mortgages, the interest rates are really low, so a lot of people are capitalizing on that and it's just a really good time to buy a home," says Caswell. "They seem reasonable to me. I'm not an expert but they do seem reasonable," says potential buyer Lori Scott. Scott is on the hunt for a new house, and says despite the increase in price, she is still ready to move. "I would like to move and just find something bigger but there would be the problem of could we sell our house right now and then the money that we need to get out of it in order to afford something a little bigger." Steve Minor and his wife just listed their home. "Just got it listed this week and then, so there's an open house today. Hopefully there's a lot more movement," says Minor. "It looks like 2011 is going to move in that direction. It's a good pace moving into 2011 so we're looking forward to it," says Caswell. This also seems to be the trend nationally. Sales of existing homes jumped 12 percent in December. Source: http://www.news25.us/Global/story.asp?S=13893668 Monday, January 24 2011

2010 on par with 2009; Today’s release of the “Indiana Real Estate Markets Report” by the Indiana Association of REALTORS® (IAR) provides the usual month-over-month comparison and because of timing, also provides a comparison of calendar years that supports the association’s past recommendation for reviewing housing data in the long-term.

“The federal homebuyer tax credit was only in play for a third of last year. And yet, the numbers show the market on par with 2009, which might take some who listen to non-local news by surprise,” said Karl Berron, Chief Executive Officer.

.

Source: IAR

Thursday, January 13 2011

Market Watch January 2011

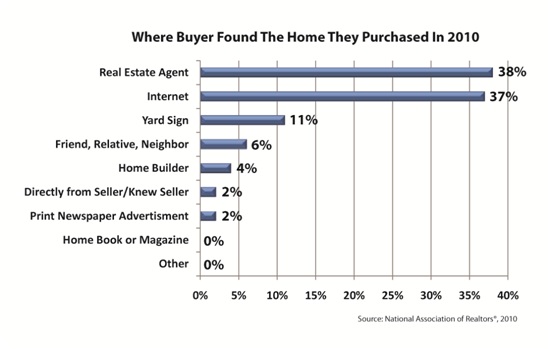

The holidays are over. A new year has started and I know the snow won’t last forever. Every year The National Association surveys thousands of buyers and sellers who purchased or sold homes the preceding year. Below you will see the most recent chart detailing where buyer’s found the home they purchased.

Over the past few years F. C. Tucker Emge Realtors and I have adjusted the way we market homes. These changes are based on buyer behavior. Not surprisingly, the biggest change in buyer behavior has been a shift away from print media toward the internet for their real estate needs. In 2001 only 8% of buyers found their home online. Now 37% find their home online. Over the same time period the number of buyers who found their home in the newspaper or some type of home magazine declined from 9% to only 2%. The only source helping buyers find homes more than the internet is their real estate agent. These are exactly the reasons that we have focused more of our advertising efforts on our web site and other tech tools instead of other less efficient options. Not only do we have the Tri-States leading real estate website but we are in the process of adding even more helpful features. I’ll discuss some of those changes next month. In the meantime stay warm and safe. I’m already working on improving my marketing efforts for 2011 and look forward to a great year.

Please feel free to call or email me if you have any questions. You can reach me at 812-499-9234 or Rolando@TheTrentiniTeam.com

Friday, November 12 2010

For over a year now Market Watch has focused on statistical information. I will continue to provide that sort of information on a regular basis. This month, however, I will step back and take a “big picture” look at the housing market, long term trends, and general advice I would give to prospective homebuyers or sellers. Please feel free to call or email me at 812-499-9234 if you have any questions. Monday, October 04 2010

Monday, July 19 2010

Local realtors say they're selling more homes this year than last.

Monday, July 19 2010

Market Watch For July 2010 We now have results from June closings and as I suggested, closed transactions declined from April and May. Although June closings were almost 21% below May levels they were still slightly higher than the average for the preceding twelve months. I do not expect July closings to be significantly different from June. 2010 will be something of a mirror image of 2009 for closed transactions. The second half of 2009 was significantly stronger than the first half of 2009. I believe that the first six months of 2010 will be stronger than the second six months of 2010. The reason for this disparity in both years is the timing of tax credits. The initial homebuyer tax credit expired in November of 2009. The tax credits were subsequently extended and they expired in April of 2010. I do not expect any renewal of these tax credits. The best news going forward is that interest rates are at some of the lowest levels in history. Since home prices are lower than they were a few years ago, and rates are great, you can buy more house with a lower monthly payment than at any time in recent history. We have also made shopping for homes easier than ever. We just introduced Tuckermobile.com. This allows you to shop for homes quickly from your smart phone. Now you can find everything from anywhere, any time. Simply go to Tuckermobile.com and you can search by Street name, MLS number, zip code or any of several other options. You can also save properties you select. If you have signed up for MyFCTuckerEmge.com any saved properties you select on Tuckermobile.com will automatically appear on your saved searches. All of this is free. All of this is automatic. None of it requires a download and it gives you 24/7 access to the entire MLS system from your smart phone. I can’t do anything about the temperature outside but I can help you shop from where ever you are comfortable. Give me a call if I can help with any of your real estate needs and as always I really appreciate referrals if you know of someone else that is thinking about buying or selling. Wishing you a great summer and we look forward talking to you soon. Sunday, June 27 2010

The Report, found online at www.IndianaIsHomge.com, was the first-ever county-by-county comparison of existing single-family home sales in Indiana. In March, statistics on other types of existing, single-family home sales - condominiums, duplexes, townhomes, mobile homes, etc. - was added to the report. IAR obtains the data directly from 26 of the state's 27 Multiple Listing Services (MLSs), including the Broker Listing Cooperative® (BLC®) in central Indiana. To date, the Report represents 98% of the housing market statewide and 91 of 92 Indiana counties. Statewide, May sales of all types of existing, single-family homes increased 25.9% from the same month last year; median prices saw an increase of 5%. This is the third consecutive month that there has been an increase in sales and the eighth consecutive month that there has been an increase in median prices over the previous year. "Because those who took advantage of the federal tax credit have until June 30th to close their transaction, we don't yet have a clear idea of what the credit's expiration will mean to our local markets," said Karl Berron, Chief Executive Officer. "Over the next few months, our reports will become more robust, including information on pending sales and other indicators that will help us understand impact of the tax credit. "The good news is that median prices did enjoy a welcomed five percent increase over last May," continued Berron. "Regardless of the availability of the tax credit, we expect prices to remain relatively stable with the potential for some softness if demand indicators continue to wane." In coming months, as Berron mentioned, the Report will include information on new listings, pending sales, average sales price, percent of original list price received at sale, housing affordability and month's supply of inventory. Reportisode #9, archived along the right side of the Reports tab at www.IndianaIsHome.com, is still of interest. It talks about the other incentives available to help consumers achieve their dream of homeownership, namely the Market Stabilization Program created by the Indiana Housing & Community Development Authority (IHCDA) to minimize the negative effects of foreclosures in many Hoosier communities. That program runs through the end of June. More about "Indiana Is Home" It is a multi-media project hosted by media professional Pat Carlini and aimed at keeping Hoosier homeowners, would-be homeowners, policymakers and the media well-informed on the ever-changing local real estate markets. Indianapolis-based Boost Media and Entertainment shot and produced all videos found at www.IndianaIsHome.com. Source: http://www.indianaishome.com/4_0_Reports.asp

Saturday, June 26 2010

Existing-home sales remained at elevated levels in May on buyer response to the tax credit, characterized by stabilizing home prices and historically low mortgage interest rates, according to the National Association of REALTORS®. Gains in the West and South were offset by a decline in the Northeast; the Midwest was steady.

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums, and co-ops, were at a seasonally adjusted annual rate of 5.66 million units in May, down 2.2 percent from an upwardly revised surge of 5.79 million units in April. May closings are 19.2 percent above the 4.75 million-unit level in May 2009; April sales were revised to show an 8.0 percent monthly gain. Buyers Face Purchasing Delays Lawrence Yun, NAR chief economist, said he expects one more month of elevated home sales. “We are witnessing the ongoing effects of the home buyer tax credit, which we’ll also see in June real estate closings,” he said. “However, approximately 180,000 home buyers who signed a contract in good faith to receive the tax credit may not be able to finalize by the end of June due to delays in the mortgage process, particularly for short sales. “In addition, many potential sales are being delayed by an interruption in the National Flood Insurance Program. Florida and Louisiana, also impacted by the oil spill, have the highest percentage of homes that require flood insurance.” As the leading advocate for homeownership issues, NAR is supporting Senate amendments to extend the home buyer tax credit closing deadline through September 30 for contracts written by April 30, and to renew the flood insurance program. “Sales and related local economic activity would have been higher without delays in the closing process or flood insurance issues,” Yun noted. Housing Still Affordable According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to 4.89 percent in May from 5.10 percent in April; the rate was 4.86 percent in May 2009. The national median existing-home price for all housing types was $179,600 in May, up 2.7 percent from May 2009. Distressed homes slipped to 31 percent of sales last month, compared with 33 percent in April; it was also 33 percent in May 2009. NAR President Vicki Cox Golder said home prices have been stabilizing all year. “With distressed sales at roughly the same level as a year ago, the gain in home prices is a hopeful sign that the market is in a good position to stand on its own without further government stimulus,” she said. “Very affordable mortgage interest rates and stabilizing home prices are encouraging home buyers who were on the sidelines during most of the boom and bust cycle.” Pending home sales are expected to decline notably in May and June from the spring surge, but Yun added that job growth and a manageable level of foreclosures are keys to sales and price performance during the second half of the year. Inventory Falling A parallel NAR practitioner survey shows first-time buyers purchased 46 percent of homes in May, down from 49 percent in April. Investors accounted for 14 percent of transactions in May compared with 15 percent in April; the remaining sales were to repeat buyers. All-cash sales were at 25 percent in May, edging down from a 26 percent share in April. Total housing inventory at the end of May fell 3.4 percent to 3.89 million existing homes available for sale, which represents an 8.3-month supply at the current sales pace, compared with an 8.4-month supply in April. Raw unsold inventory is 1.1 percent above a year ago, but is still 14.9 percent below the record of 4.58 million in July 2008. Single-family home sales declined 1.6 percent to a seasonally adjusted annual rate of 4.98 million in May from a pace of 5.06 million in April, but are 17.5 percent above the 4.24 million level in May 2009. The median existing single-family home price was $179,400 in May, which is 2.7 percent above a year ago. Single-family median existing-home prices were higher in 16 out of 20 metropolitan statistical areas reported in May from a year ago. In addition, existing single-family home sales rose in 18 of the 20 areas from May 2009. Existing condominium and co-op sales fell 6.8 percent to a seasonally adjusted annual rate of 680,000 in May from 730,000 in April, but are 32.6 percent above the 513,000-unit pace in May 2009. The median existing condo price was $181,300 in May, up 3.4 percent from a year ago. By Region

Source: NAR http://www.realtor.org/RMODaily.nsf/pages/News2010062201?OpenDocument Friday, May 28 2010

Observers of Tri-State home sales have something to smile about. A report from the Evansville Area Association of Realtors reveals home sales in Vanderburgh, Warrick, Posey and Gibson counties continue to climb, well after federal tax incentives for buyers expired at the end of April. Chris Dickson, president-elect of the association, said the number of single-family homes in the four-county area were up 18.7 percent the first 21 days of this May, compared to the first 21 days of May 2009. The increase was slightly higher than the 17.6 percent increase in sales for all of last month, compared to April 2009, he said. “Clearly the tax credits had their intended effect. They ‘primed the pump’ and got the housing market going,” said Dickson, a real estate agent with ERA 1st Advantage Realty. “We expect the increased activity to continue, because buyers who did not find the perfect home in April are still looking.” For statistic lovers, a total of 241 homes were sold in the four counties in the first 21 days of this May, compared with 203 homes sold during the same period in 2009. Dickson said the median sale price continues to also increase, up 11.2 percent so far this May, compared to May of last year. He said the current median sale price was $123,500 vs. $111,000 a year ago. “The overall volume and contribution to the economy has increased by 33.4 percent. Over $34.3 million worth of homes were sold in the first 21 days of this May, compared to $25.7 million during the first 21 days of last May.” Dickson said that although the tax credits are no longer available for everyone, they are still available for people in the U.S. military. “Also, there is plenty of FHA and conventional mortgage money available,” he said. “Interest rates are still at historic lows. Interest rates for a 30-year fixed rate are available for around 5 percent.” Source: http://www.courierpress.com/news/2010/may/26/tri-state-home-sales-continue-be-strong/ Tuesday, May 25 2010

The Indiana Association of REALTORS® (IAR) today released its "Indiana Real Estate Markets Report" for the month of April as a continuation of its "Indiana is Home" project. The Report, found online at www.IndianaIsHome.com, was the first-ever county-by-county comparison of existing single-family home sales in Indiana. In March, statistics on other types of existing, single-family home sales - condominiums, duplexes, townhomes, mobile homes, etc. - was added to the report. IAR obtains the data directly from 26 of the state's 27 Multiple Listing Services (MLSs), including the Broker Listing Cooperative® (BLC®) in central Indiana. To date, the Report represents 98% of the housing market statewide and 91 of 92 Indiana counties. Statewide, April sales of all types of existing, single-family homes increased 28.4% from the same month last year; median prices saw an increase of 13.7%. This is the seventh consecutive month that there has been an increase in median prices over the previous year. "April showed continuation of an expected spring surge due to the federal tax credit," said Karl Berron, Chief Executive Officer. "While the increase in sales is positive, the best news is that inventory is trending down and there seems to be a broad stabilization in home prices, demonstrating that the tax credit did its job to preserve housing wealth." Tuesday, May 18 2010

As I said last month, pended transactions (signed contracts for sales not yet closed) for March were great. Pended transactions for April were simply off the chart. I believe that pended transactions for March and April combined were the best two month period in local MLS history. As a result, inventory was just over 7 month’s supply. I think the important questions, as a result of the past two months performance, are what does this mean and where are we going? I think we know several things and we can draw some conclusions. First, closed transactions during May and June will be excellent. This will continue to keep inventory levels relatively low especially compared to unusually high levels we saw at the beginning of the year. I also believe that the homebuyer tax credits that expired at the end of April were clearly a factor in these remarkable sales numbers. The key question is: how big a factor were the tax credits? If average pended transactions for May-July are only down 25% from April’s spectacular numbers the housing market is in excellent condition. If pended transactions are down closer to 50% then we still have to wait for a fuller recovery. I believe that the number will be between 30-40%. That indicates that things have definitely improved and we are moving in the right direction, but we still have room for improvement. Two other bright spots are an improvement in closed transactions over $200,000 and an improvement in sales price to list price percentage. For homes over $200,000 sales are up 31.3% in the first four months of this year compared to the same four months last year. Sales price to list price in April was 95.83%, the highest percentage in almost two years. This is another sign of our improving market. School will be out soon and I’m looking forward to a great summer. It’s easy to look for homes anytime, regardless of the weather, at http://TheTrentiniTeam.com Monday, April 12 2010

What a difference a year, and maybe a little sunshine can make. Real estate sales in March were significantly better; by practically any measure, than they were just a year ago. January and February of 2010 from a local real estate perspective were virtually identical to the same two months in 2009, but everything changed for the better in March. Last month, in our area, we closed 391 home sales, compared to 307 a year ago, a 27.4% increase. The average sale price this March, on those closed sales was $123,980 compared to $114,002 last March, an 8.8% increase. Finally the supply of homes on the market, measured by month’s supply, declined to 7.45 months compared to 9.7 month’s supply last March. The 7.45 month supply was the second lowest monthly total in the past two years. Only June of 2009 with 7.37 month’s supply was better. National surveys suggested that March was going to be a good month in many parts of the country. The Pending Home Sales Index (PHSI) is a forward looking indicator based on contracts signed, but not yet closed, increased in February. The PHSI in February of 2010 was 17.3% above the corresponding month in 2009. Since contracts typically take 1-2 months to close increased March closings were inevitable. So what does this mean going forward? I am confident that closed sales in April will be significantly higher than last April. (OK I cheated on this one because I know that pending transactions were higher this March than last March) I am also confident that closed transactions will stay strong in May. The unknown is the degree to which the expiration of The Home Buyer’s Tax Credit will affect sales this summer. The credit expires if contracts are not signed by April 30. I believe that sales this summer will be similar to last summer’s putting our market on a more steady and sustainable level. I know we all want to avoid the significant price and sales declines of 2008 and 2009, and I believe we will; Great news for both buyers and sellers. Friday, March 19 2010

Realtors cite federal tax credit, very low interest rate. The $6,500 federal tax credit for home-owners buying their next home is being credited for part of the upward movement in house prices in Vanderburgh and surrounding counties. According to a report by the Evansville Area Association of Realtors, the sale price of single-family homes in Vanderburgh, Warrick, Posey and Gibson counties in January and February increased by 13.5 percent over the same period last year. Chris Dickson, the association's president-elect, said he believes the tax credit brought out buyers for homes in the range of $150,000 to $250,000. "There are more buyers in the market looking to take advantage of the federal tax incentives," said Dickson. "The fact that average sale prices in 2010 are starting out strong, compared to 2009, also shows that the housing market in this area continues to rebound." Dickson also attributed the increase in part to mortgage rates that remain at historic lows. Bob Reid, president of the Realtors association, agreed. He predicted March and April also will be strong as the April 30 deadline nears for the expiration of the $6,500 tax credit and for the $8,000 federal tax credit for first-time home buyers. "There's been no discussion about extending the credits," Reid said. According to Reid, a person must sign a contract agreement to buy a house by April 30 and must close on the house purchase by June 30 to be eligible for the tax credits. In January and February this year, the average house sale price in the four counties was $126,282, up from $111,603 in the same two months in 2009, according to the association report. In Vanderburgh County, the average sale price for the two months rose 7.7 percent to $104,380. The price was $96,849 for the same period in 2009. Dickson said Warrick County had the biggest increase, rising by 15.59 percent to $186,818, compared with $161,148 in 2009. The number of homes sold in the four-county area remained about the same: 341 sold the past two months compared with 343 for the same period last year. The number of days it took to sell a house on average was 100 in January and February, compared with 110 in 2009. Because of the increase in the average sale price, the overall volume rose 12.8 percent with more than $43.1 million in homes sold in January and February, compared with $38.2 million last January and February. "Unfortunately," Dickson said, "many sellers are under the mistaken impression that the market is poor, so they are hesitant to put their homes on the market." As a result, the number of homes available to buyers dropped to its lowest level in over two years, according to Dickson. "We need more homes on the market to supply the buyer demand. ... Homes that are in good condition and priced well are selling." Source: http://www.courierpress.com/news/2010/mar/17/area-home-prices-on-the-rise/ Tuesday, March 16 2010

The snow is gone and we are ready to sell some homes. It seems however that our market is not leading the nation in the housing recovery. Almost half of the country showed an increase in the price of homes in the 4th quarter compared to the previous year. The number of homes sold increased in 48 states in the 4th quarter compared to the 4th quarter of the previous year. Nationally the supply of homes on the market is less than 6.5 months. These are all positive and encouraging statistics.

When the real estate market started slowing a couple of years ago our market stayed stronger longer and never declined to the same extent as the nation as a whole. Since our market slow down started later and since we did not fall as far, our recovery is running a little later than most parts of the country. For the first two months of 2010 our market is virtually unchanged having closed 2 fewer homes than the corresponding period in 2009. Average prices however were slightly higher at $118,075 compared to $112,319. Our inventory of homes is still too high at just under 12 months supply. I am certain that we will show a significant increase in closed sales in March compared to January or February. We have also seen more activity in more expensive home transactions in the past few months. Pending transactions increased significantly the second half of February and I firmly believe that sales will stay strong at least through April. I am confident about the April date partially because of the Home Buyers tax credit which is still available for contracts that are completed by April 30 and close by June 30. Smart shoppers and prudent sellers need to act soon to take advantage of this credit before it expires.

Remember the best place to start your home search is at FCTuckerEmge.com, where you can register yourself and receive automatic notifications at My FCTuckerEmge.com. Signing up is simple and easy.

Saturday, February 27 2010